Bookkeeping includes the documentation, on regular basis, of financial transactions of a company or an organization. Companies may monitor all the details on their books with proper bookkeeping to make key working, spending, and funding decisions. Bookkeepers are people for businesses that handle all financial details.

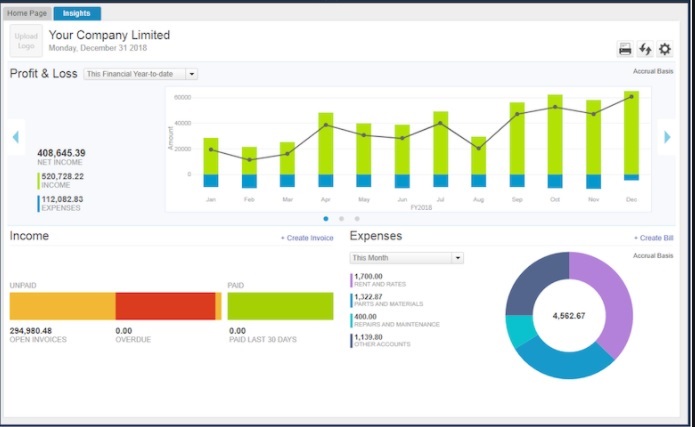

QuickBooks is a software used for Bookkeeping by small businesses and individuals. It has more than 2 million users worldwide, and 80%-plus market share prove. These figures indicate the increased market demand of Bookkeeping and QuickBooks.

Whether you are seeking a bookkeeping job, starting a business, or launching your on bookkeeping or account practice. Becoming QuickBooks certified would really give you advantage over others. You might be asking yourself Is Bookkeeping and QuickBooks Courses Near Me available?

The answer is yes indeed. We provide Bookkeeping and QuickBook course at TSCER.

Here is what you need to know about how to become Certified in QuickBooks and Bookkeeping.

What is the role of a bookkeeper?

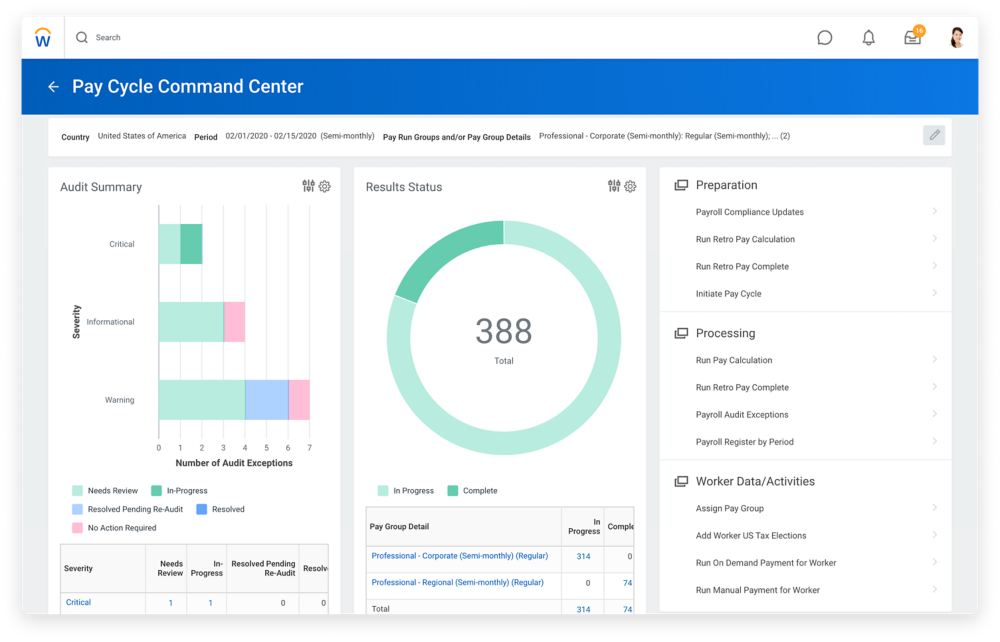

A bookkeeper systematically records financial transactions and prepare financial statements. Since bookkeeper deals with records of money transfer therefore, it needs to be done carefully. Thus, a bookkeeper’s job is to:

- collecting financial data

- recognizing transactions of monetary nature and measuring them in terms of money

- recording the financial impact of the monetary transactions

- classifying the effects of the financial transactions and

- preparing organized financial statements

Every business requires a bookkeeper to effectively manage their accounts. However, a bookkeeper must be efficient in filing tax returns and financial statements with their local revenue authorities.

Why to become certified in Bookkeeping and QuickBooks?

It is not important to become a certified bookkeeper to continue a business or get a bookkeeping job. However, getting certified will add credentials to your performance, and will help you stand out from the herd.

Getting certified in Bookkeeping will give you the following benefits:

- Certification courses give you concrete skills and knowledge of Bookkeeping and QuickBooks.

- It provides authentication of your skills and increase your chances of getting hired for the job.

- It will help you make the best use of the software to run your or your client’s business at the greatest potential.

- Getting certified will give you the required skills to train others about bookkeeping and QuickBooks.

Therefore, in order to become efficient in bookkeeping one needs to have command over certain skills. Certified courses gives you the required information to enhance your skills. In this article, you will know how to become a certified bookkeeper through various short certification of bookkeeping courses.

How to Learn QuickBooks and Bookkeeping?

Learning QuickBooks and Bookkeeping is not a difficult task. There are two ways to learn bookkeeping, self-Paced learning, or Certified/Degree Courses.

How to become QuickBooks Certified?

How to become QuickBooks certified? The challenging task is deciding to choose which course to take.

One of the effective ways and options are if you want to get certified in QuickBooks. You can take courses from any nearby college, however, they many not allow you to adjust your required time in their schedules. Therefore, you need to properly enroll in the specified time and follow the rigid schedules. However, if you think to learn at your pace and available time then TSCER provides you with the opportunities to carry out the training at your pace after you register yourself for certain courses. TSCER considers understands your challenges and provides you opportunity to adjust your time according to your needs. The timing also depends on which timeslot and course options are available to you.

How to Become Certified QuickBooks Bookkeeper?

Do you want to improve your bookkeeping experience and knowledge with a certification COURSE? Here are three easy steps to follow.

Attend training class.

The first step is attending training or classes to understand QuickBooks and bookkeeping. During the training, you will learn everything from QuickBooks to handling money. The duration of the training varies depending on the specific training you get yourself registered with. Some courses are as short as one—two or longer comprising on many weeks such those available on TSCER. Depending on your choice of subject and availability, you can enroll yourself in a course that best suits your schedule.

Entering in the Exam

Taking the exam is the most crucial step. Once you have taking all the classes and trainings, you are required to take the exam. Appearing in the exam will be equally feasible as the organizations will help you find the authorized testing center near you. You can also take the exam online in case if necessary.

Getting Certificate

To get the certificate you need to clear the exam. However, it is not a big deal if you have already registered in a good course as TSCER is offering. That will ensure your certification.

How difficult is the Test to Get QuickBooks Certified?

For beginners, the test could be pretty hard. As you with regular practice, you can come over the difficulty level. The pattern of the test could vary from organization. However, preparing for the test is not difficult at all. Therefore, preparing on your own could be a risk. It is reliable to enroll in certificate course, as it will provide you with all the required skills to make your way to certification.

How Costly is QuickBooks and Bookkeeping Certification?

The cost of the training entirely depends on the organization you register with. At TSCER you have the most eligible veteran available at the most affordable cost. You can also have discount courses depending on your need.

Why to Take Bookkeeping and QuickBooks TSCER is?

TSCER provides financial assistance to need based, unemployed, disables, and eligible veterans, and other educational training programs. It is suggestable for having the following features.

· Convenient Training Schedule

It will not require you to quit your job. You can study being part time, evening, morning, or weekend student at convenience of your schedule.

· From Anywhere You Want

To facilitate you TSCER.ORG offer virtual training and joint meeting bringing in live training via Expert Coach.

· Mock Trainings

You will also be provided practice server and license software to help you get trained with hands on tools. This facility is hard to get anywhere else.

· After Training Support-Recruitment

Yes, this is what you find. Not only you will be given the course, but also help you the best to help you find and employer.

· 50% Off if You Do not Qualify.

If you do not qualify in final testing. You are still eligible for free enrollment in next class of same subject or waived 50% to enter any other course.

Course Outlines

Following are the course outlines you can opt to enroll in

- Introduction to Financial Accounting

- Financial Accounting Fundamentals

- Fundamentals of Accounting Specialization

- Reading Financial Statements

- Introduction to Corporate Finance

- Financial Analysis Fundamentals

- Fixed Income Financials

- Budgeting and Forecasting

- Excel Crash Course

Are you looking for a certification course? Then it is an excellent opportunity to earn certification. You need to hurry up and enroll as each passing day will lead you to pay extra cost and is also likely to increase the losses which you are have in the absence the certification.

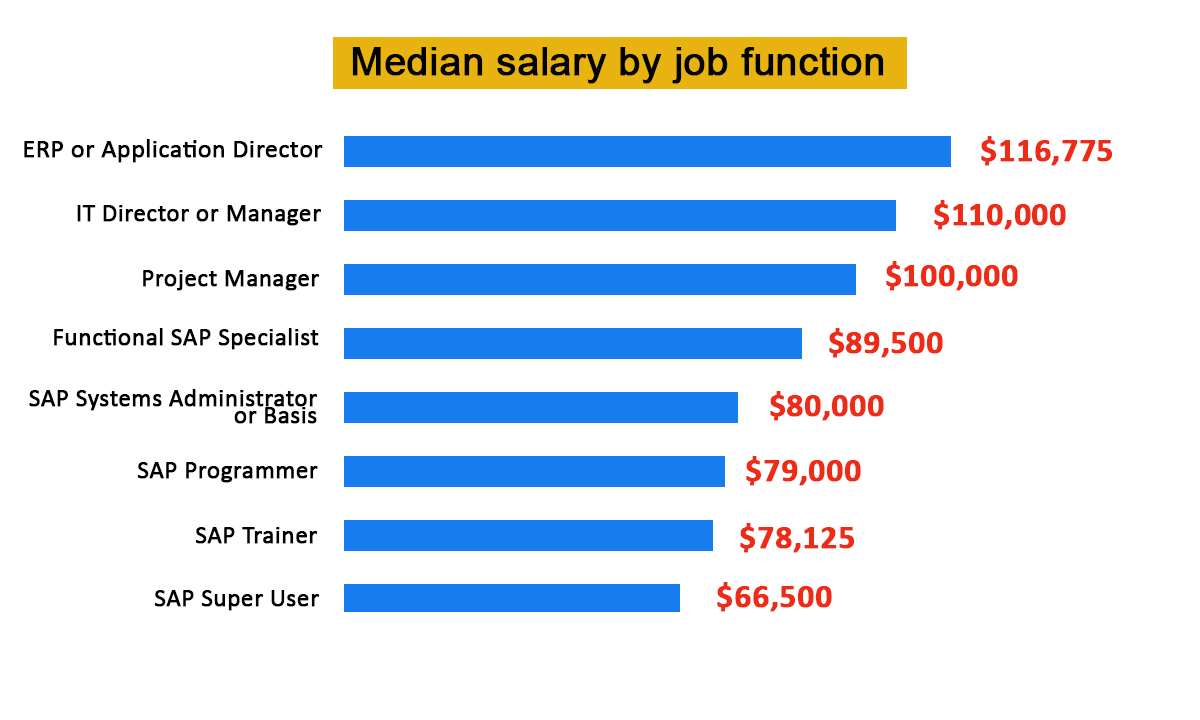

Salary of Bookkeeping and QuickBooks bears

The salary of Bookkeeping and QuickBooks bearers are significantly high as per Zip recruiter’s statistics.

| Job Title | Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage |

| CPA Firm Bookkeeper | $65,553 | $5,463 | $1,261 | $31.52 |

| QuickBooks Remote | $64,952 | $5,413 | $1,249 | $31.23 |

| Work From Home Bookkeeper | $58,536 | $4,878 | $1,126 | $28.14 |

| QuickBooks Consultant | $57,986 | $4,832 | $1,115 | $27.88 |

| Head Bookkeeper | $56,417 | $4,701 | $1,085 | $27.12 |

Source: ziprecruiter

Similarly the salary range is depicted in Salary for Skill: Intuit QuickBooks $50,165

Similarly the salary range for Intuit QuickBooks is $50, 165 which is indeed significantly high compared to other trades.

Source: PayScale

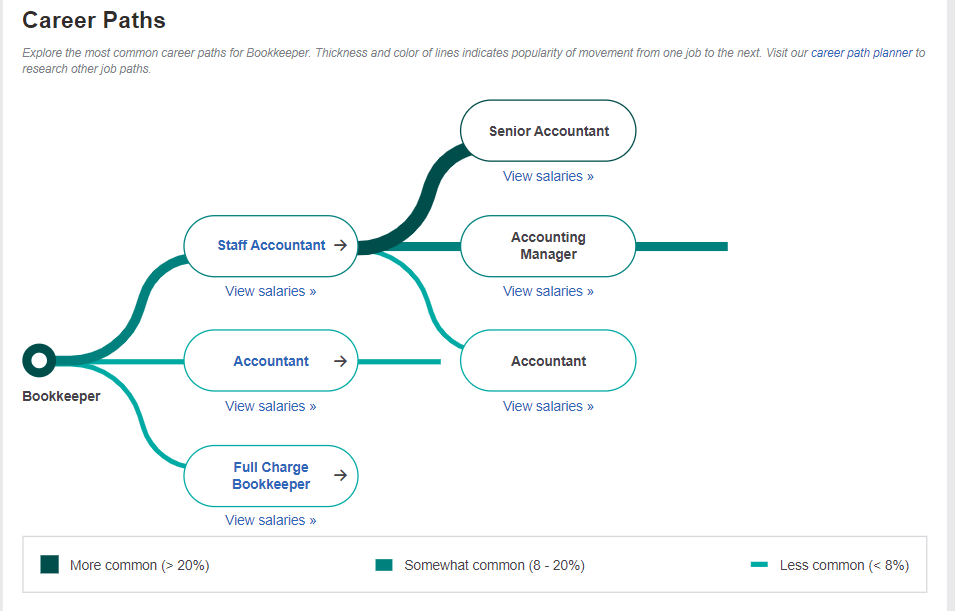

Likewise in term of the prospect of career growth is also guaranteed provided the holder of office have earned certifications in Bookkeeping and QuickBooks. They can move from their entry level into the job market at the level and then move to various positions. PayScale has portrayed the career path of certified for Bookkeeping and QuickBooks in the following map:

Source: payscale.com

Conclusion

QuickBooks is one of the most demanding and easy to use bookkeeping software. Learning bookkeeping will not only enhance your capacity to get a better job, it will also enhance to further your career growth. Furthermore, it will also enhance your capacity to run your own small business as well. QuickBooks courses. Certification courses are most desired and preferred by students, professionals, and business owners.

Becoming certified in bookkeeping can earn you several benefits, such as giving you the basic required knowledge and skills to best use QuickBooks. However, choosing courses could be challenging. There are several courses available online that gives certifications. However, which way to go for depends on one’s need and affordability. Going for the courses that are convenient with your schedule as well as do not compromise on the quality are the ones one should refer opt for. Since they are not very costly and in some case discounts available. Thus the mentioned features makes TSCER as one of the best platforms for learning bookkeeping. You can opt for the training and register to earn a certificates that guarantees you’re your entry at a very reasonable level. Only sesbile people take quick decisions in opting for the right type of course which have promising job guarantees and also paves the way for an attractive career path.

Career-path Bookkeeping and QuickBooks bears